Paynex tackles the root causes of delayed settlements, empowering businesses to receive funds instantly.Built on trusted partnerships, we move forward—directly toward your next stage of growth.

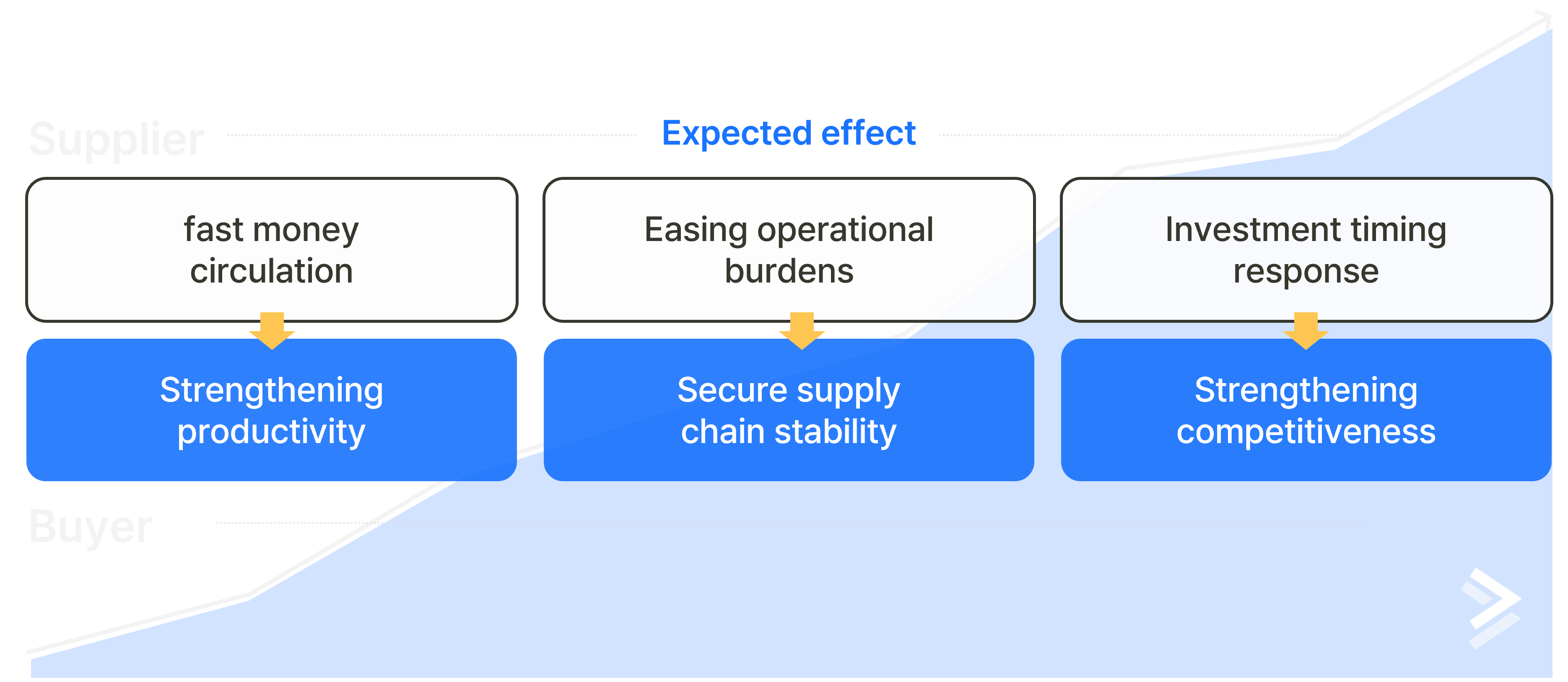

Although sales are confirmed after pre-purchasing raw materials and completing delivery, delayed settlements disrupt liquidity and create a vicious cycle of cash flow constraints.

During periods of declining raw material prices, companies miss the timing for bulk purchases—losing both profit opportunities and large-scale order requests.

Dependence on high-interest short-term loans leads to heavy interest burdens and reduced profitability, while frequent borrowing results in credit rating downgrades.

Managerial stress and liquidity shortages increase the burden of R&D, equipment, and facility investment, ultimately weakening long-term productivity and competitiveness.

자금 흐름 악순환을 해결하고 대량 발주 및 긴급 물량 대응, 납품 확대가 가능합니다.

Elimination of delivery delay risks and expectation of long-term order growth.

Gain from raw material price spreads and strengthen overall competitiveness.

Here are answers to frequently asked questions.

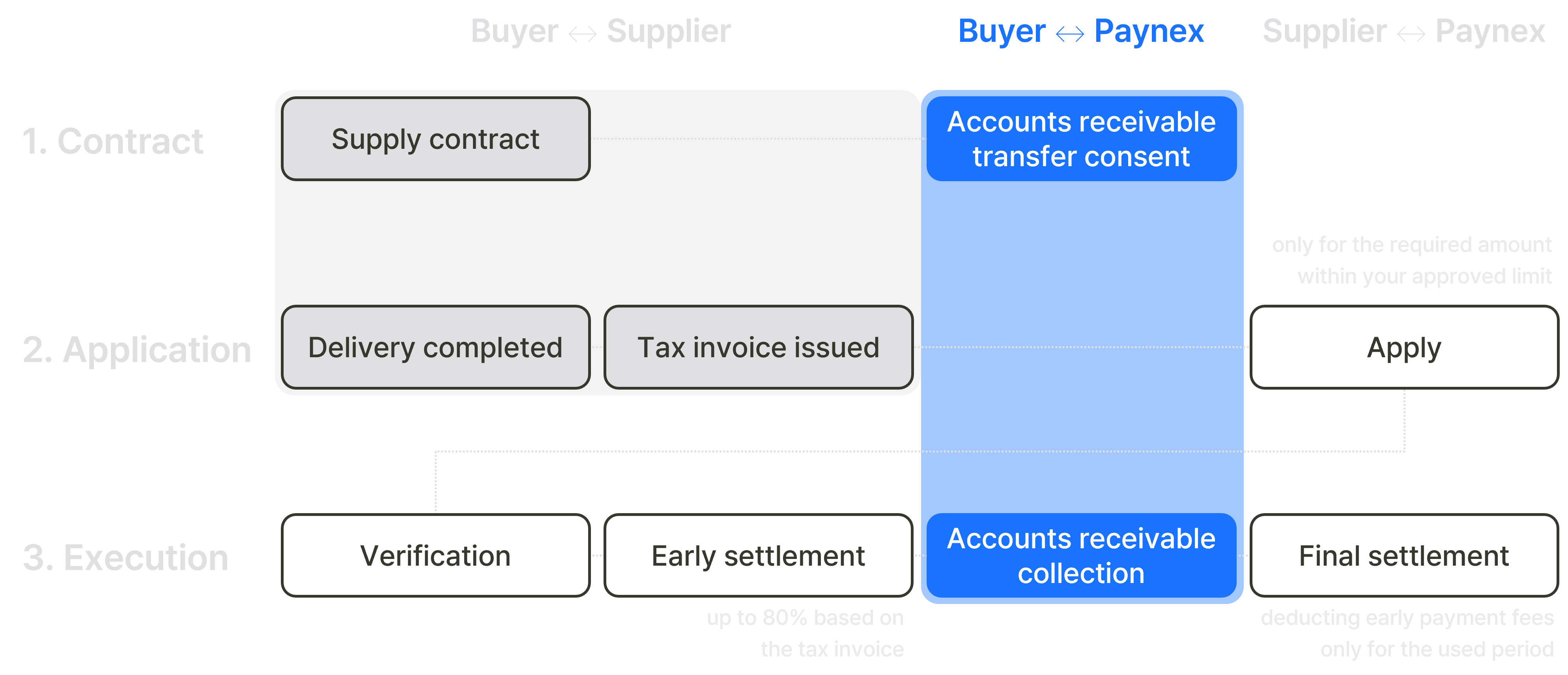

Simply submit basic documents and complete an online application.

You can apply via the Paynex website or email, and a dedicated manager will guide you through the process.

Fees are determined based on each company’s credit rating and receivable stability,

and are charged daily on the amount actually used.

Your limit is set through an internal review based on sales volume, client stability, and delivery history.

Early payment is provided only after confirmed delivery and sales,

and client credit assessments are conducted in advance to ensure stability.